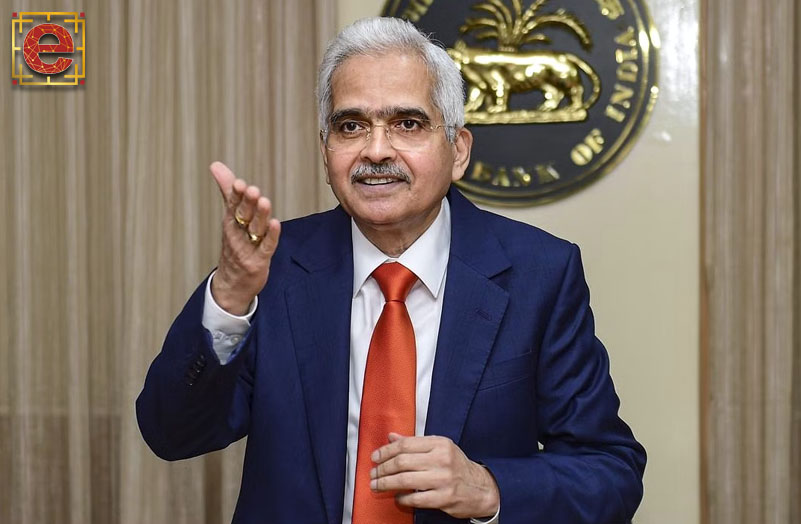

The Reserve Bank of India (RBI) on Thursday kept the repo rate unchanged at 6.50 per cent. RBI Governor Shaktikanta Das, announcing the statement of monetary policy said, “The RBI’s Monetary Policy Committee (MPC) unanimously decided to keep the repo rate unchanged at 6.50 per cent.” It is being seen as a huge relief for EMI payers amid rising inflation.

Advertisement

Advertisement

The RBI governor said, “Amidst this volatility, the banking and non banking financial service sector in India remain healthy, and financial markets have evolved, in an orderly manner. Economic activity remains resilient, and real GDP growth is expected to have been 7 per cent in FY23.”

Das said that the GDP is expected to jump 6.5 per cent in the current financial year. He added, “Retail inflation is expected to moderate to 5.2 per cent in FY 2023-24.”

“The MPC also decided by a majority of five out of six members to remain focused on “withdrawal of accommodation” to ensure that inflation progressively aligns with the target while supporting growth, the RBI governor added.

During pandemic RBI did not change repo rate. But since May, 2022 RBI commenced raising Repo rate. Thereafter repo rate has been hiked for six times.

Advertisement